Consolidated Mineral Estates is the largest shareholder in Battery Elements Corp, which is in the process of being listed on the Canadian Stock Exchange. The strategy of Battery Elements is to roll-up past producing Antimony mines, diversified across jurisdictions, with a goal of being the largest non-Chinese producer of Antimony.

CSM is represented on the board of Battery Elements with three directors.

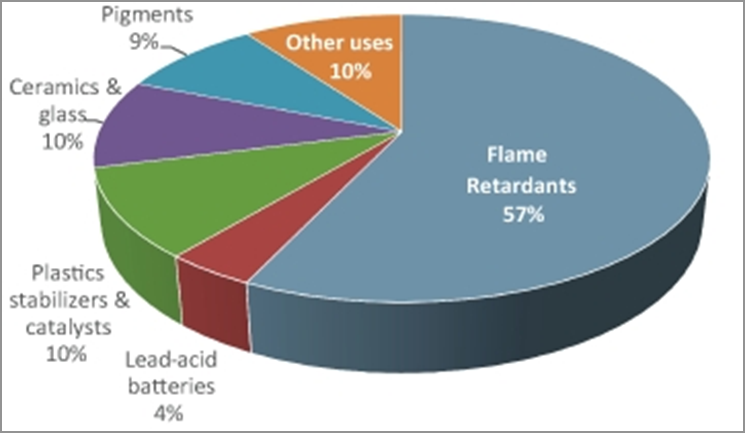

Applications

The most important historical use of antimony metal is as a hardener in lead for storage batteries. The metal also finds applications in solders and other alloys.

Antimony trioxide is the most important of the antimony compounds and is primarily used in flame-retardant formulations. These flame-retardant applications include such markets as children’s clothing, toys, aircraft and automobile seat covers.

Antimony is also used as an alloy in small arms ammunition, buckshot, tracer ammunition, and cable sheathing.

Antimony is increasingly being used in semiconductor & microchip manufacturing and in prototype molten-salt batteries.

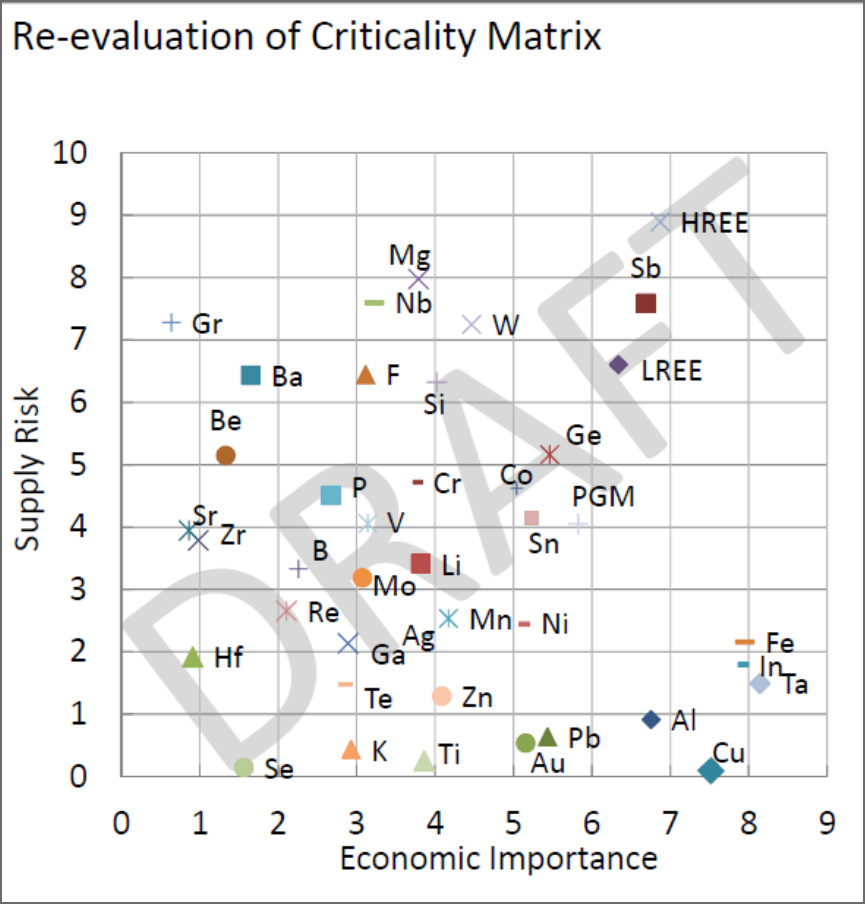

In this matrix prepared by JOGMEC, the Japanese government agency, can be seen the EU’s criticality rankings adjusted for the needs of Japanese industry.

The positioning of Antimony is noticeable with only the much talked about Heavy Rare Earths coming out with a higher criticality score.

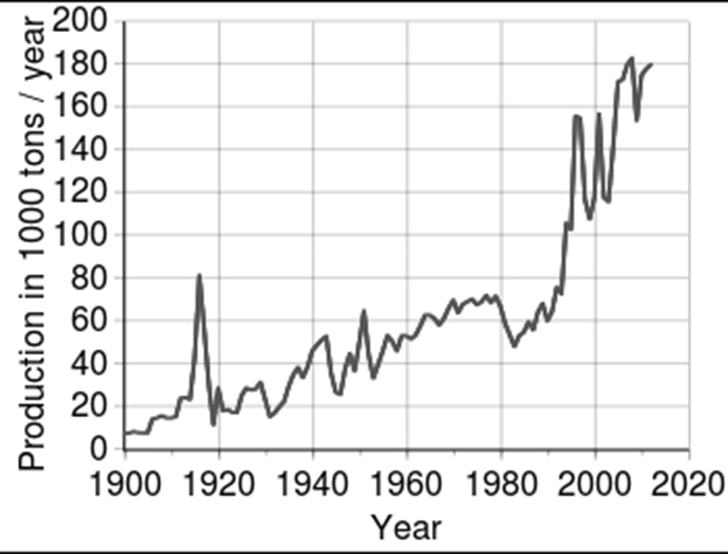

Historically surges in Antimony production usually occurred in times of war due to its usage in ammunition. The chart below shows the massive rise during the First World War then a pronounced rise during the 1940s and again in the Korean War.

The metal then began a secular rise with gradual demand increases in the post-war economic boom but the real kicker came from the 1980s onwards due to the increasing use as a fire retardant and in plastic master-batches.

Demand was doused somewhat by the 2009-11 price spike. Short of new applications demand should grow at 2-3% per annum.

Sourcing

Antimony is not a difficult product to mine though mines are rarely large.

Besides the patchy artisanal sources such as Bolivia, Honduras, Laos and Burma, countries such as Canada and Australia (as well as Slovakia, Spain and Italy) have been producers of note at various times in recent decades. Canada’s mines were producing until as recently as the 1980s and 1990s before being pushed out of business by predatory pricing by the Chinese. The Chinese reopened the Beaverbrook mine in 2020 and then closed it again a few months later.

The only non-Chinese production on a measurable scale in recent years has been:

- Costerfield in Victoria, Australia, owned by Mandalay Resources. Offtake goes to China to expedite gold recovery from concentrate.

- Hillgrove in NSW, Australia, owned by Red River Resources – currently being revived – ore was toll-roasted in Mexico by US Antimony for a couple of years, mid last-decade.

Pricing

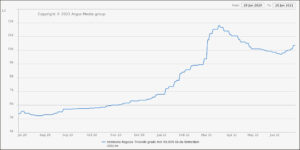

The price of Antimony had been depressed since the early 1980s. The price moved strongly higher in 2009 on supply problems with the main producer, China.

Prices then slumped again reaching levels in 2016, that prompted the closure of the Consolidated Murchison mine.

Two actions caused production reductions in China, the world’s leading antimony producer. In March 2010, the Government froze approval of any new projects for antimony mining, then the Government shut down about 100 antimony smelters (according to the USGS) in China’s dominant antimony-producing region, an action aimed at closing illegal mines and curbing pollution.

Chinese annual production represents one sixth of its total reserves. As usual one needs to take both production and reserve numbers for China with the usual caveats. However, some industry sources are musing that China could stop exports in the future and even become a net importer in coming years.

Rationale

Antimony is an interesting niche metals market. Before dismissing it as “too small” though we would note the US produces no Sb and yet imports 22,000 tpa and the price peaked a couple of years back at over $15,000 per tonne. To this should be added the opportunities to penetrate markets in Asia (outside of China) and in Europe where users are concerned on potential disruptions to Chinese supply.

Prices have rebounded and indications are that production may remain constrained by Chinese policies. The tide of Chinese exports has been turned. China falling into deficit would produce higher prices and a scramble for production.